Introduction: The Relevance of Advanced Personal Cash Flow

Advanced personal cash flow has become a cornerstone of strategic financial planning. Rapid technological innovation, volatile economies, and new investment vehicles force individuals to surpass elementary budgeting in favor of more nuanced personal cash flow management. For investors and high net worth individuals, optimizing personal cash flow is no longer optional—it’s a prerequisite for both capital growth and risk mitigation.

The ability to predict cash inflows and outflows with precision separates astute investors from the rest. As financial institutions roll out intricate digital tools and fintech platforms proliferate, the playing field now favors those who proactively engage with advanced cash flow methodologies. Exploring these strategies not only futureproofs one’s wealth but also unlocks superior opportunities to deploy capital efficiently, weather market disruptions, and adapt to new financial realities.

What Is Advanced Personal Cash Flow Optimization?

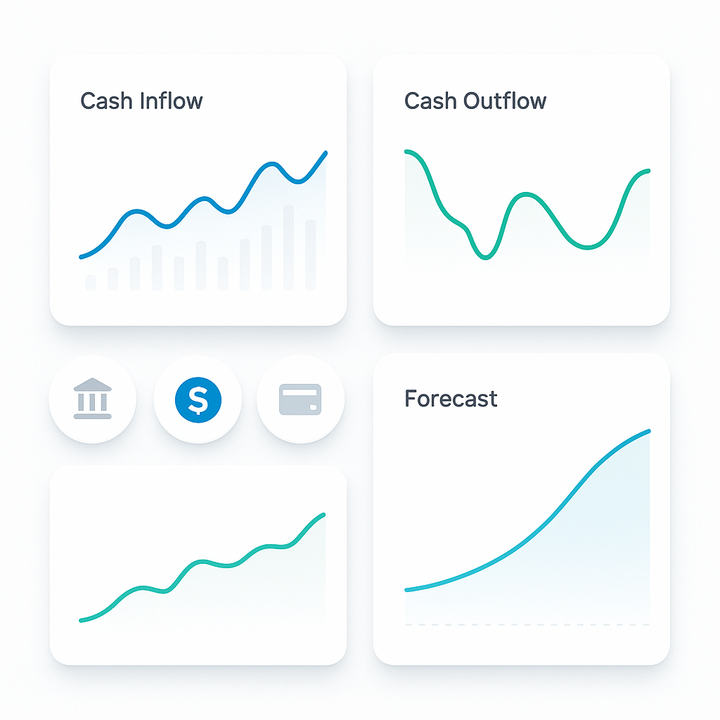

At its core, advanced personal cash flow optimization is the application of high-level strategies and specialized tools to closely monitor, analyze, and direct both income and expenditures. Instead of simply tracking expenses or sticking to a basic budget, this approach employs real-time analytics, scenario planning, and integrated automation to manage a spectrum of financial activity. Individuals examine income streams—including salary, dividends, interest, and passive or alternative sources—alongside meticulously categorized expenditures.

Advanced personal cash flow techniques involve tools like API-linked aggregators that consolidate data across accounts, machine learning algorithms that identify trends or anomalies, and scenario models that project future liquidity needs. By using such systems, individuals expose hidden inefficiencies, spot liquidity gaps before they arise, and adjust allocations to maintain cash readiness. Unlike traditional budgeting, these strategies enable users to match capital deployment with investment timelines, market expectations, and unique risk tolerance levels.

Why Advanced Personal Cash Flow Matters for Investors

For investors, advanced personal cash flow drives improved investment decisions, better risk management, and increased market agility. Without sophisticated cash flow analysis, investors face the danger of unexpected liquidity shortfalls, which can force untimely asset sales or missed high-potential opportunities. Advanced personal cash flow management links liquidity planning to scheduled obligations, market trends, and the investor’s broader strategic goals.

With enhanced transparency, investors gain the confidence to capitalize on market disruptions or rebalance portfolios without jeopardizing core cash needs. Detailed cash flow forecasts allow for calculated leveraging, optimal position sizing, and swift tactical moves. Furthermore, this approach supports diversification by freeing up surplus capital for new opportunities while ensuring existing assets remain shielded from premature liquidation due to unforeseen expenses.

Core Techniques in Advanced Personal Cash Flow Planning

Advanced personal cash flow planning employs a toolkit of dynamic mapping, scenario modeling, and responsive automation. Dynamic cash flow mapping starts by aggregating data from all accounts—savings, checking, brokerage, retirement, even digital wallets—to create a comprehensive real-time dashboard. This consolidation exposes inefficiencies and spots periods of excess or scarce liquidity more clearly than siloed reviews ever could.

Scenario modeling builds on this by running probabilistic forecasts. Individuals stress-test various situations, such as a sudden drop in rental income, an unexpected medical expense, or a market-wide correction, to assess readiness and adjust reserves proactively. Automation introduces convenience and discipline. Smart tools automate transfers to investment accounts, set up programmable savings triggers, and implement rules-based selling or rebalancing when predefined liquidity thresholds are met. Integration of these techniques fosters both agility and resilience in personal finance.

Technology’s Impact: Supercharging Liquidity Management

The rise of financial technology (fintech) has utterly transformed advanced personal cash flow management. Fintech platforms now offer API-driven account aggregation, allowing seamless integration and central monitoring of all assets and liabilities in real time. Predictive analytics crunch historical income and spending patterns to more accurately anticipate future cash demands. For example, adaptive algorithms can identify when your monthly utility costs spike or flag a one-off windfall worth reallocating toward investments.

AI-driven categorization streamlines oversight, while real-time alerts about unusual expenses or significant variations prompt timely interventions. Many digital banks facilitate instant sweep transfers of idle funds, route dividends directly into high-yield accounts, or even trigger liquidity cushions in a brokerage account based on evolving market conditions. Moreover, integrated credit management features offer frictionless access to pre-approved credit when cash dips below predetermined thresholds, acting as a flexible safety net during temporary mismatches.

Practical Steps to Optimize Advanced Personal Cash Flow

Implementing advanced personal cash flow optimization effectively requires a methodical approach. Begin by tracking every source of income, including nontraditional streams like consulting, royalties, or rental income. Use account aggregation software to centralize this data for holistic visibility.

Next, scrutinize both fixed and variable expenses, looking for patterns or seasonal variations. Automate the distribution of income into various accounts earmarked for investment, emergency funds, or major upcoming expenses. For example, use programmable rules to direct a higher percentage of bonuses into growth assets, or schedule periodic transfers to tax-advantaged accounts.

Strategically leverage credit products to manage volatility. Deploy reward-optimized credit cards for recurring monthly spending and utilize low-interest revolving lines to smooth occasional liquidity gaps. Supplement these moves by placing idle cash into high-yield transaction or sweep accounts to ensure every dollar works toward enhancing net liquidity.

Finally, set a regular cadence—quarterly or semiannually—for reviewing and updating your automated rules. Life events, market shifts, and evolving tax codes all warrant periodic reassessment to maintain optimal alignment with your personal financial plan.

Risk Management in Advanced Personal Cash Flow Optimization

No strategy is without risk. Advanced personal cash flow techniques introduce new complexities that must be managed vigilantly. Overreliance on automation can backfire if software misclassifies a key expenditure or executes a transfer in error. Exposure to cybersecurity threats multiplies as more accounts and platforms are interconnected, demanding robust digital hygiene and active monitoring for anomalies.

Furthermore, systemic liquidity mismatches may occur if scenario models use faulty inputs or if leveraged positions amplify unforeseen shocks. Investors who forget to factor in personal obligations—such as quarterly taxes or one-off family expenses—can find their liquidity buffer evaporating at the worst possible time. However, the disciplined use of advanced tools serves to both mitigate risk and capture upside when managed with adequate human oversight and an adaptable framework.

Examples: Advanced Personal Cash Flow in Practice

Consider an investor with diversified streams: employment income, short-term rentals, dividends from stocks, and periodic consulting fees. Instead of letting excess cash languish in a checking account, the investor uses a fintech app that consolidates all accounts into a single interface. Each week, the system analyzes receipts and auto-routes available funds toward high-yield savings, retirement contributions, or scheduled quarterly payments—ensuring that cash sits unproductively for the shortest possible time.

Suppose the investor anticipates a high upcoming expense, such as a property renovation. Scenario modeling reveals a pending liquidity gap three months in advance. The system automatically scales back periodic investments, reroutes upcoming dividends into the main account, and even suggests tapping a low-rate line of credit to avoid forced asset sales during unfavorable market conditions.

Throughout the process, the investor receives real-time alerts if spending exceeds historical averages or if unusual charges appear, ensuring issues are addressed immediately. After the event, the investor reviews the outcome and fine-tunes their cash flow rules, maintaining continuous improvement and adaptability.

Integrating Advanced Personal Cash Flow Strategies with Investment Planning

Advanced personal cash flow optimization aligns closely with long-term investment planning. While traditional advice often separates budgeting from portfolio management, today’s integrated approach treats liquidity and investment as two sides of the same coin. For instance, investors can schedule contributions to new asset classes—such as private equity or crypto—based on short-term cash windfalls or expense lulls. This strategy maximizes efficiency, allowing for greater investment flexibility without sacrificing essential liquidity.

Timing is crucial. Advanced personal cash flow analytics alert investors to shifts in surplus cash that can be quickly redeployed when markets present opportunities. This approach reduces the opportunity cost associated with uninvested cash and provides more room to capitalize on high-conviction trades, launches, or early-stage opportunities. As asset classes and financial instruments become more complex, a robust personal cash flow strategy remains essential for optimizing both immediate and long-term financial outcomes.

Conclusion: Strategic Adaptation for Financial Success

Mastering advanced personal cash flow is fundamental for those aiming to build and preserve wealth in the face of uncertainty. As financial markets and personal circumstances change, proactive management remains key. Continuous education, regular reassessment, and effective use of technology allow individuals and investors to adapt and thrive. For more insights and actionable content on Advanced Personal Finance, visit our dedicated section.