Introduction: Why Risk and Return Analysis Matters in 2024

Risk and return analysis remains a cornerstone of smart investing in 2024. Investors face heightened volatility, shifting economic tides, and technological transformation. A clear grasp of risk and return analysis empowers investors to optimize asset allocation, target diverse opportunities, and steer portfolios toward long-term goals. As innovative asset types and analytic tools emerge, a solid foundation in risk and return analysis determines success in a dynamic marketplace.

Defining Risk and Return in Financial Markets

At its core, risk and return analysis assesses the variability of investment outcomes. Risk is the likelihood that returns deviate from expectations, potentially resulting in losses. Market risk reflects broad economic forces, while idiosyncratic risks are unique to individual assets. Additionally, liquidity risk and credit risk profoundly influence how investors approach various asset classes.

Returns, meanwhile, represent the gains or losses derived from an investment, measured against the initial capital committed. Investors evaluate returns as percentages or annualized yields, depending on asset class and strategy. Quantitative tools such as standard deviation, Sharpe ratio, and beta express risk and reward in mathematical terms, while advanced models consider correlations, scenario impacts, and factor exposures.

Institutional investors add rigor by stress testing portfolios, simulating market shocks, and employing multi-factor models. Nevertheless, the essential aim of risk and return analysis is understanding each asset’s place in the larger market ecosystem. Macroeconomic shifts, regulatory changes, and technology upgrades reshape risk factors regularly, compelling investors to continuously update their approach.

Why Investors Rely on Risk and Return Analysis

Risk and return analysis shapes every investor’s strategy. With it, investors align asset choices with specific goals, timeframes, and risk appetite. Decision-making rooted in risk and return analysis helps investors avoid impulsive choices, such as chasing hot trends or panic selling on downturns, which can undermine long-term performance.

Through systematic evaluation, investors diversify portfolios, reducing the sting of losses in any one area. Modern analytics and access to expansive historical datasets allow for increasingly accurate predictions about volatility and returns. Thus, investors can calibrate portfolios, anticipating both risk and reward with greater confidence.

Additionally, with greater data transparency, investors tailor portfolios to reflect personal values, such as incorporating ESG considerations, or capitalize on sectoral trends rapidly. Top-down and bottom-up analytics now merge as advanced platforms offer both overview and granular insights into portfolio risk and potential returns.

Effective Strategies for Applying Risk and Return Analysis

Strategic asset allocation is the backbone of strong risk-return management. Modern portfolio theory (MPT) emphasizes the importance of diversification across uncorrelated assets to dampen volatility and optimize returns. By distributing capital among asset classes with distinct risk profiles, investors build resilience against unexpected market shocks.

Factor investing expands these principles, targeting systematic drivers of return—like value, size, or momentum. By inspecting the risk and return analysis of each factor, investors tilt allocations towards sources of performance likely to persist. Periodic portfolio rebalancing maintains the desired risk profile, counteracting drifts from original allocations as market values shift.

Moreover, advanced scenario analysis provides insight into portfolio behavior during adverse conditions such as economic downturns or interest rate shocks. Investors spot vulnerabilities and implement hedging, for instance, via protective options or alternative assets. Real-time analytics, risk dashboards, and automated alerts now allow investors to respond swiftly, creating an edge in dynamic environments.

Institutional and retail investors alike employ Monte Carlo simulations to assess potential portfolio outcomes under countless scenarios. Sensitivity analyses further highlight which variables most strongly impact expected returns or losses—a vital step in refining any investment plan.

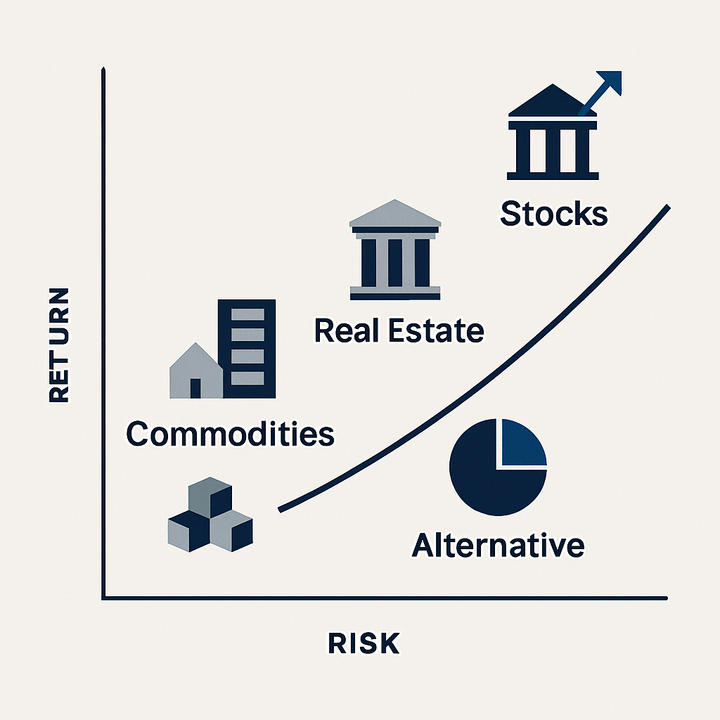

Examining Risk and Return Across Major Asset Classes

Equities: Growth and Volatility

Equities—stocks—historically generate robust long-term returns, largely through capital appreciation and dividends. However, their inherent volatility results from market sentiment, economic cycles, and geopolitical uncertainty. During downturns or sector disruptions, equity prices can plummet quickly, exposing investors to significant short-term risk.

Investors measure this risk using standard deviation, beta (which tracks sensitivity to market swings), and value-at-risk (VaR). Sector diversification and global equity exposure can reduce company-specific or regional risk, but cannot eliminate market-wide volatility. For those seeking growth with an understanding of sharp drawdowns, risk and return analysis in equities is crucial.

Fixed Income: Stability and Interest Rate Sensitivity

Fixed income investments, such as government and corporate bonds, provide regular interest payments and principal protection at maturity. Their returns are generally more stable than those of equities but come with unique risks—particularly, sensitivity to interest rate movements (duration risk) and issuer default (credit risk). When interest rates climb, bond prices fall, driving down returns.

Investors use metrics such as duration, yield to maturity, and credit spread to gauge risks and rewards. Diversifying bond holdings by issuer quality, region, and maturity profile helps manage volatility and reduce credit event exposure.

Real Estate: Income, Appreciation, and Illiquidity

Real estate offers a blend of predictable rental income and potential price appreciation. It reacts to economic, demographic, and regulatory changes, and holds value during inflationary periods. Nevertheless, real estate is less liquid, often requiring longer commitment and incurring higher transaction costs.

Location-based risks, local market cycles, and funding availability further increase uncertainty. Investors analyze risk and return through capitalization rates, debt service coverage ratios, and market vacancy trends.

Commodities: Diversification with Cyclical Volatility

Commodities—energy, metals, agriculture—add diversification due to their low correlation with stocks and bonds. Their risk and return analysis must account for supply-demand imbalances, currency exchange rates, and global trade policies. These markets are susceptible to sudden price swings caused by weather, geopolitical tensions, or technological shifts.

Investors track volatility indexes, inventory data, and historical correlations when integrating commodities into diversified portfolios. Timing remains critical, as cycles of boom and bust can quickly reshape returns.

Alternative Assets: New Risk Frontiers

Alternative assets are increasingly favored for their uncorrelated returns and unique risk-return patterns. This category includes private equity, hedge funds, infrastructure, venture capital, collectibles, and digital assets such as cryptocurrencies. Each alternative asset introduces heightened complexity in risk and return analysis due to limited historical data, lower liquidity, and regulatory ambiguity.

Private assets often require long investment horizons, while hedge funds deploy diverse, sometimes leveraged, strategies to extract alpha. Venture capital opportunities may yield outsized rewards but carry high failure rates. Digital assets, meanwhile, experience extreme price swings and security challenges, requiring robust risk management frameworks.

Institutional investors rely on advanced models, rigorous due diligence, and scenario planning to navigate these risks. Individual investors should understand the distinct characteristics—such as lock-up periods or high fees—before allocating capital.

Managing Diversification Risks and Opportunities

Diversification is a fundamental risk control practice, yet relying solely on historical correlations can mislead investors. During market crises, asset correlations tend to converge, reducing protection. Therefore, dynamically updating risk and return analysis with up-to-date data is vital.

Emerging tools like smart beta, machine learning models, and real-time portfolio analytics allow adaptive diversification. Investors now monitor inflation risk, currency volatility, and geopolitical disruptions more precisely. Thematic investments and ESG integration further layer in new opportunities and complexities in assessing risk and return across asset classes.

Regular portfolio reviews and stress tests preserve intended diversification benefits, allowing investors to rebalance proactively. Seeking out alternative and global exposures adds resilience but calls for disciplined research and monitoring.

Technological Innovation in Risk-Return Management

Rapid advances in technology have transformed risk and return analysis. Artificial intelligence (AI), cloud-based analytics, and big data platforms provide real-time risk metrics and deeper pattern recognition. These tools empower investors with predictive models, automated alerts, and analytic dashboards that surface emerging risks or profit opportunities quickly.

For example, Monte Carlo simulations assess portfolio behavior in thousands of future market scenarios, improving planning for tail risks. Machine learning algorithms detect non-obvious correlations and shifting regime patterns. Alternative data—including satellite imagery, credit card transactions, and sentiment analysis—reveals trends traditional analysis may miss.

The regulatory environment is evolving too, with authorities requiring sophisticated, transparent risk frameworks and robust scenario testing from institutional players. For all investors, keeping pace with innovation is critical to sustain robust risk and return analysis strategies.

Essential Tools, Metrics, and Trends for the Future

The toolkit for risk and return analysis is expanding rapidly. Key metrics like standard deviation, Sharpe and Sortino ratios, and value-at-risk enable clear comparison across asset classes. Investors use maximum drawdown to quantify the worst observed loss during a specific period—vital for assessing downside exposure.

Trends point to an increased reliance on automated rebalancing and integrated platforms that consolidate data for multi-asset portfolios. ESG factors and climate risk assessments are becoming mainstream considerations. Clients increasingly demand customization, flexibility, and transparency in both risk and return tracking.

Emerging strategies combine traditional wisdom with modern analytics. For instance, traditional 60/40 portfolios are now frequently supplemented with alternatives to boost risk-adjusted returns. The increased use of exchange-traded funds (ETFs), smart beta products, and direct indexing offers investors granular control over exposures and risk preferences.

Conclusion: Enhancing Financial Decision-Making Through Risk and Return Analysis

The continuing evolution of financial markets underscores the need for robust risk and return analysis. By mastering the principles and adopting new technological tools, investors construct resilient, adaptive portfolios that weather volatility and seize opportunity. Sustained learning, periodic review, and openness to innovation are the hallmarks of successful, informed investing. For deeper guidance and detailed approaches to asset diversification, visit our dedicated Investing and Diversification resources for expanded commentary, expert analyses, and actionable strategies.